- The Supply Times

- Posts

- Netflix and Paramount Duke It Out

Netflix and Paramount Duke It Out

The Supply Times Issue #90

Hello, dear readers!

Many of our favorite shows involve some sort of final battle. Harry Potter fights Voldemort to save the wizarding world. The Stranger Things kids battle Vecna for the survival of Hawkins. And now, we’re watching Netflix battle it out with Paramount Skydance over the richest prize of all: Warner Brothers. Read on to discover how the bidding war went down, and what it means for Hollywood, shareholders, and viewers.

Also, it’s the last issue of 2025! The Supply Times is nearing two exciting milestones: our 10,000th active subscriber, and our 100th issue. Perhaps both things will happen in the same week next year? In the meantime, I’ve shared some of the highlights from the past 12 months, including my top four workforce trends, top 10 book recommendations, and much more.

Let’s get going.

Industry Highlights: The Battle For Warner Brothers

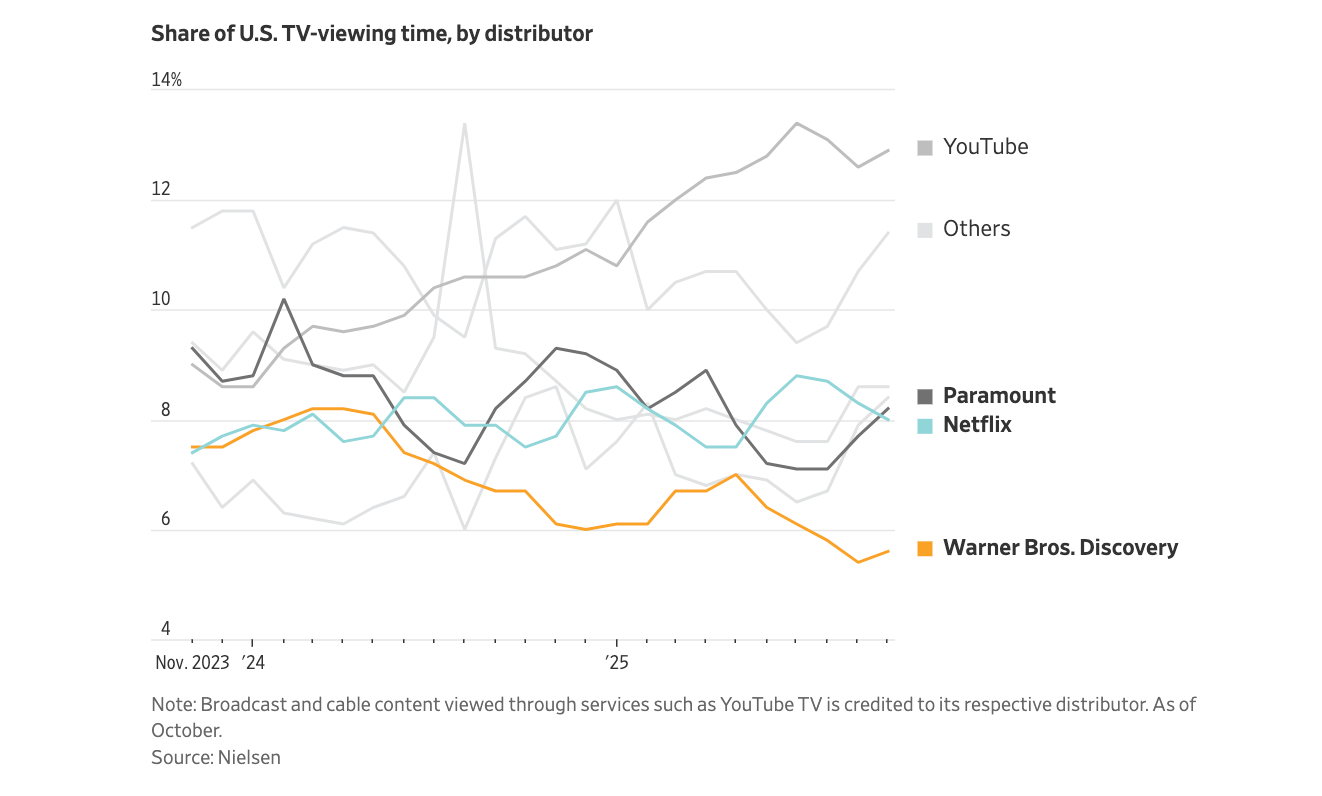

The streaming wars have taken a new twist with Netflix and Paramount going head-to-head in their bids for Warner Bros Discovery. Both companies are eager to expand their portfolios, but their approaches have sparked debate among analysts and shareholders. Here’s a look at the evolving situation.

What went down

Netflix kicked off this bidding war with a headline-grabbing proposal valuing Warner Bros’ studio and streaming networks, including HBO, at a staggering $83 billion, factoring in debt. They offered shareholders $23.25 per share, plus a mixed bag of cash and equity that they claim is worth around $27.75 per share. This proposal caused a buzz among investors, but not everyone was convinced.

On the other side, we have Paramount, backed by the wealthy Ellison family, making waves with a hostile bid. Their offer is a direct $30 per share to acquire all of Warner Bros, which includes their traditional TV networks. They pitched this as a "superior alternative" to Netflix's plan, boasting a more significant cash component for shareholders and less regulatory pushback.

How the two bids differ

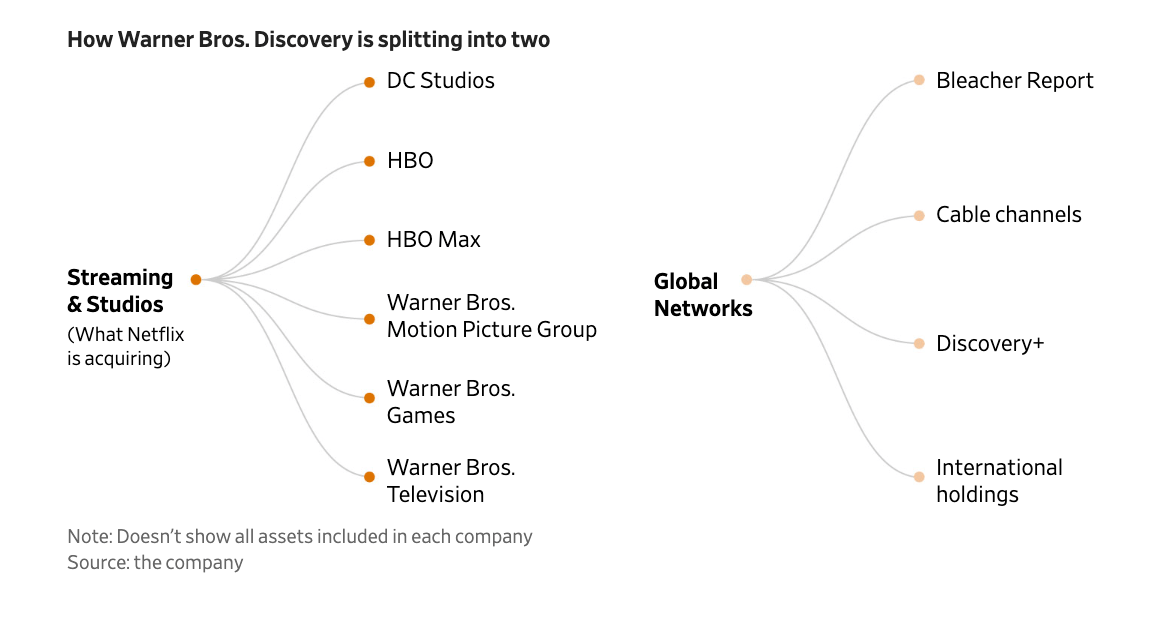

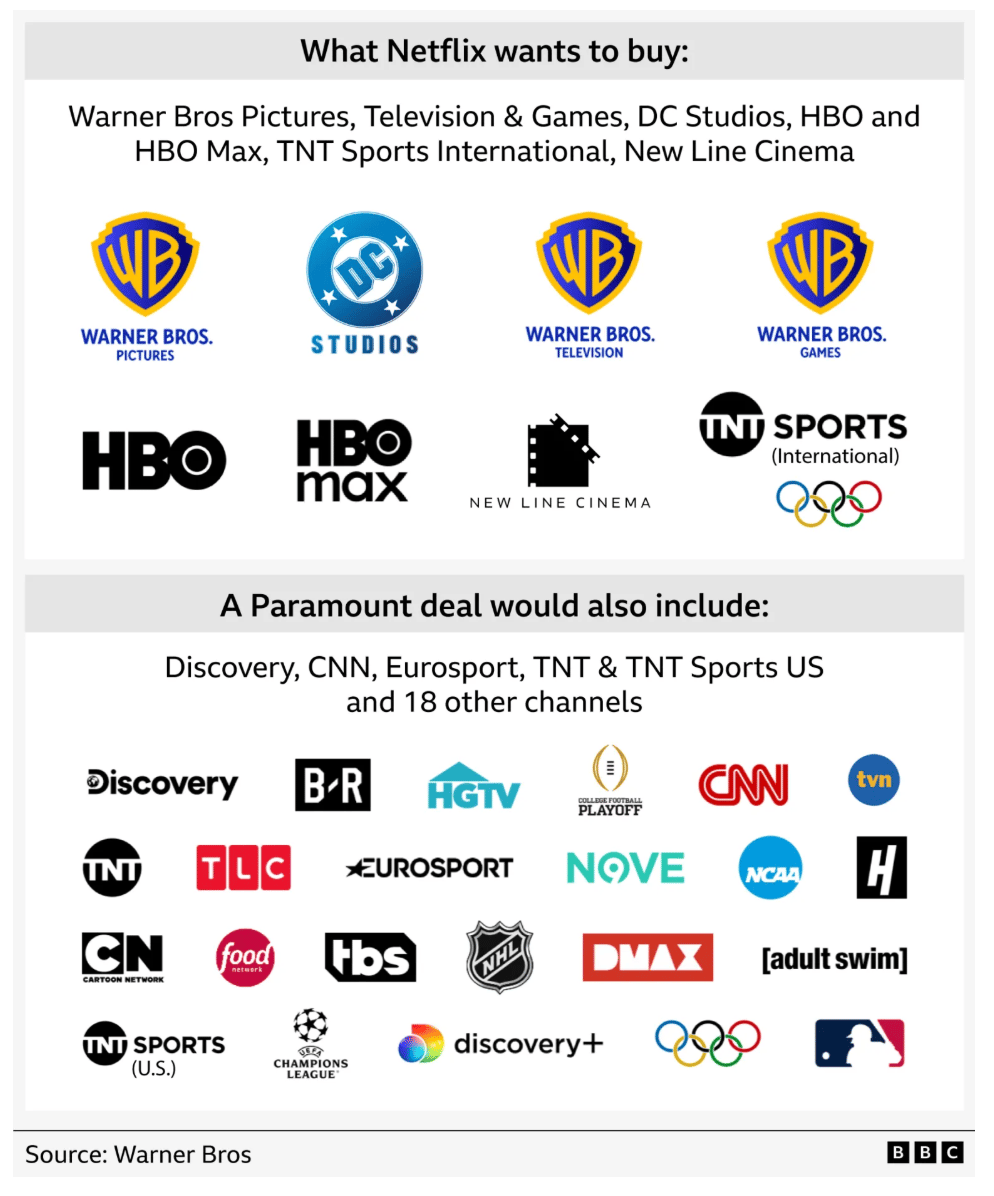

At first glance, the main difference between the two bids comes down to structure. Netflix’s proposal is somewhat complex, combining cash with equity, which might confuse some shareholders. In contrast, Paramount's offer looks straightforward: cold hard cash. While Netflix's valuation of $83 billion focuses primarily on Warner Bros’ cutting-edge streaming platforms, Paramount is looking at a broader inventory, valuing the whole company at about $108.4 billion, including traditional broadcasts.

Moreover, Paramount’s bid seeks to secure control over Warner Bros’ longstanding television networks, an area Netflix seems less interested in given its streaming-heavy model.

How Are Netflix and Paramount financing their bids?

Netflix was able to make its ambitious bid with a $59 billion bridge loan led by Wells Fargo. This financing is one of the largest of its kind for acquisition funding. The company is also planning to raise around $25 billion through an unsecured bond offering, alongside additional loan facilities. After a slight dip in its stock prices following the announcement, Netflix's CFO, Spencer Neumann, reassured investors of their commitment to maintaining a solid balance sheet and restoring credit ratings within two years post-acquisition.

On the other hand, Paramount's financing strategy for its bid involves a complex web of funding sources. David Ellison's family, including Larry Ellison (co-founder of Oracle and one of the richest individuals globally) backed the bid but only provided about $12 billion of the $41 billion in equity needed. Paramount's offer relies significantly on financial contributions from Middle Eastern sovereign wealth funds, alongside investments from U.S. private equity firms, including one led by Jared Kushner, Donald Trump's son-in-law. This multi-tiered approach to financing has faced scrutiny, particularly regarding foreign investment and national security concerns, making it a focal point in the bidding process.

Who Is likely to win?

Predicting a winner is tricky, as both bids have compelling aspects and significant drawbacks. Netflix’s sheer size raises eyebrows about potential monopoly issues, especially in light of Trump's recent comments about competition concerns. While Paramount is smaller, analysts argue that a merger could create a more formidable opponent to giants like Netflix and Disney.

Many observers believe that the relationship between the Ellison family and Trump might tilt the scales in Paramount’s favor. Their connections could facilitate smoother regulatory navigation.

Paramount's all-cash offer of $30 per share provides immediate liquidity, which is appealing compared to the mixed-value approach of Netflix. If Warner Bros opts for Paramount, shareholders will secure a more straightforward exit. However, if Netflix takes the helm, the potential for future gains could be significant if the combined entity thrives.

What it will mean for viewers

From a viewer's perspective, the implications of either takeover are profound. If Netflix wins, subscribers will see a deeper catalog bolstered by Warner Bros' beloved properties, from Looney Tunes to Harry Potter. Conversely, Paramount’s acquisition could lead to new content that blends its cinema clout with traditional television and streaming efficiencies. No matter what happens, streaming prices are likely to keep trending upwards:

As for the long-term impacts on cinema, these deals could reshape how content is produced, marketed, and consumed. Among Hollywood’s creatives, Netflix has long been blamed for killing movie theatres. The Paramount offer is equally feared due to concerns about closeness to the White House raising the possibility of potential censorship and government overreach. Predictably, Hollywood is bracing for more upheaval and job losses as a result of the acquisition.

The outcome of this battle could redefine the entertainment landscape for years to come. Whether you're rooting for Netflix or Paramount, one thing is clear: this saga is far from over.

Let me finish with a quote from GQ’s Jack King:

“The upside? The Sopranos on Netflix, probably. The downside? Oh, y'know, just the death of cinemas.”

The Future of Work: Top Four Workforce Trends of 2025

For something a little different this issue, I’ve handpicked the top four workforce trends that I’ve covered in The Supply Times over the past 12 months. Here they are:

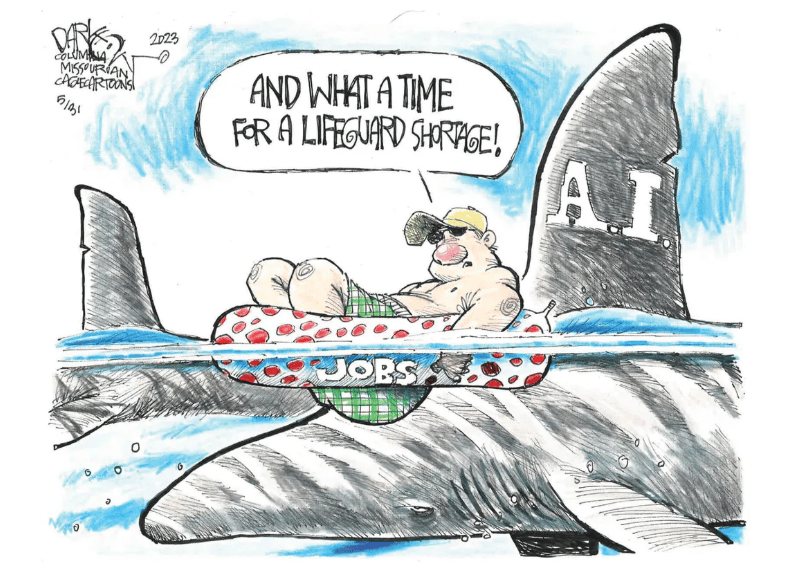

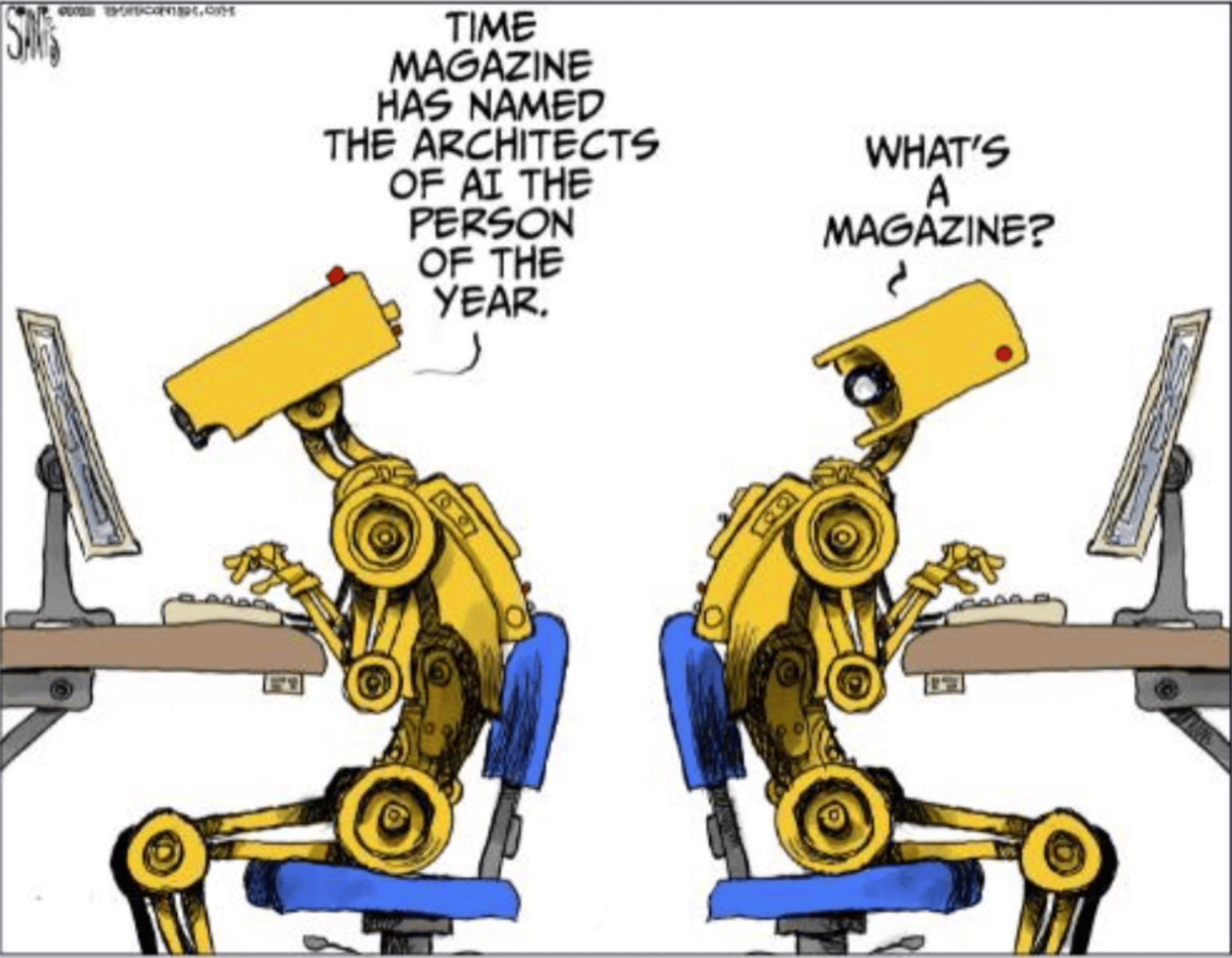

The alarming disappearance of entry-level roles: Gone (suddenly) are the days when entry-level positions were seen as the essential first step on the ladder to career success. Companies are now doubling down on AI and automation, trusting tech to undertake traditionally manual or repetitive roles such as data entry. This shift is happening at the expense of foundational roles that have long been a staple for young professionals looking to start their careers. Read more in TST issue #88.

Gen X continues to get a raw deal: Pity the “cursed generation”. Why do researchers believe people currently aged 45 to 60 are deeply unhappy compared with other cohorts? Sandwiched between long-dominant Boomers and the much larger Millennial generation, members of Gen X have been waiting in the wings for their time to shine. But what if it never comes? Find out in issue #78.

The hybrid debate is still not settled: To hybrid or not to hybrid? How is the great hybrid experiment going in terms of productivity, collaboration, and culture? Ask most employees and they’ll tell you it’s going extremely well… but employers may disagree. Check it out in issue #82.

A sharp uptick in employee monitoring: An increase in digital surveillance of employees is leading to an even more dramatic decrease in trust. This matters, because research has proven that monitoring in low-trust organizations decreases employee creativity. Read more in issue #74.

AI Insights

What will AI tackle next?

Every year, A16Z asks its investing teams to share their ideas of what they think tech builders will tackle in the year ahead. What’s notable is that their ideas are universally positive, with no AI doom-and-gloom. Here are the highlights from this year's round-up:

Taming Multimodal Data (Jennifer Li)

Enterprises are overwhelmed by unstructured multimodal data, which includes PDFs, emails, and videos, leading to inefficiencies in AI systems. Startups that can clean, structure, and validate this chaotic data will be well-placed to unlock significant opportunities. This is bigger than it sounds: addressing data entropy is seen as a generational opportunity for improving AI workloads and processes.

The Rise of Healthy MAUs (Julie Yoo)

A new healthcare segment, the "healthy MAUs," will emerge, focusing on proactive health monitoring for consumers who are not currently sick but wish to stay informed about their well-being. This shift represents a significant market opportunity for healthtech companies to offer subscription-based services aimed at prevention rather than reactive treatment, addressing a previously overlooked consumer base.

Agent-Native Infrastructure (Malika Aubakirova)

The shift to AI "agent-speed" workloads requires a fundamental redesign of infrastructure. Current systems, built for human interaction, are not equipped for the rapid, recursive tasks that agents perform. The future will demand "agent-native" platforms capable of handling large-scale parallel operations, ensuring efficiency and responsiveness.

Personalized Products (Josh Lu)

2026 is anticipated to be the "year of me," where products will become increasingly personalized. AI will tailor offerings in education, health, and media to individuals rather than mass markets, prioritizing personal preferences and biological factors. Get ready for a move away from one-size-fits-all solutions to bespoke experiences.

AI-Native Universities (Emily Bennett)

The first AI-native university is expected to emerge, fully leveraging intelligent systems for education. This institution would adapt curricula and operations based on real-time data, making learning personalized and dynamic. If the creators of this university get it right, it could become “the talent engine for the new economy”.

The Supply Aside

📕 Read - Top 10 Book Recommendations of 2025

Here are my picks of the many books I’ve recommended over the past twelve months. My new year’s resolution for 2026? H/t to Al Davis: ‘Just read, Baby!’

The Art of Spending Money: Simple Choices for a Richer Life by Morgan Housel

The Connection Cure by Julia Hotz

Guns, Germs, and Steel: The Fates of Human Societies by Jared Diamond

Outlive: The Science & Art of Longevity by Peter Attia

The Art of Uncertainty: How to Navigate Chance, Ignorance, Risk and Luck by David Spiegelhalter

The Mysterious Mr. Nakamoto: A Fifteen-Year Quest to Unmask the Secret Genius Behind Crypto by Benjamin Wallace

50 Years of Travel Tips by Kevin Kelly

Conquering Crisis: Ten Lessons to Learn Before You Need Them by William Harry McRaven

Becoming You: The Proven Method for Crafting Your Authentic Life and Career by Suzy Welch

Benjamin Franklin: An American Life by Walter Isaacson

What Else I’m Reading

The junior hiring crisis: I’ve been covering the rapid decline in entry-level jobs for a few issues now. This piece from Annie Hedgpeth dives into the emerging data, and it’s not pretty. Her advice? Getting your first role will be near-impossible unless you network, network, network.

Nvidia is buying demand: Concerns are growing about Nvidia's efforts to maintain its dominance by creating an unprecedented superstructure of investments and financing for its customers aimed at boosting demand for its products. This strategy, primarily focused on OpenAI and "neocloud" CoreWeave, looks more like financial engineering than enhanced compute engineering.

Do mega-mergers destroy shareholder value? This article looks into the recent history of M&A, finding that (historically) studies show a high failure rate. But recent data suggests companies are getting better at managing mergers, although post-merger performance has only shown modest growth. The verdict? It’s a coin toss.

I’m a little behind the ball on this one, but this interview (2024) contains some important hints to the future direction of Meta. CEO Mark Zuckerberg discusses the launch of AI Studio, what lies ahead for Meta’s smart glasses and other innovative consumer products like neural wristbands.

What stood out for me was Zuck’s dislike of the concept of “one true AI”, which seems to be the strategy pursued by Google and OpenAI. For Meta, the strategy is to create the underlying technology (Llama) for businesses and creators to use for creating their own AIs, which will be more closely tailored to their contexts and needs.

“I don’t think AI technology is a thing that should be hoarded,” he says in the video. “I find it a pretty big turnoff when people in the tech industry kind of talk about building this one true AI. It’s almost as if they think they’re creating God or something, and that’s just not what we’re doing. I don’t think that’s how this plays out.”

👂 Listen - The Knowledge Project: Mary Kay Ash

This episode of Shane Parrishe’s Outliers focuses on “the world’s greatest salesperson”, the indomitable Mary Kay Ash. You might already know the outline of this incredible success story. Born in 1918, in Texas, she faced her share of struggles, including being passed over for promotions in a male-dominated workplace. Instead of giving up, she launched Mary Kay Cosmetics in 1963 with just a $5,000 investment from her son. Her approach not only empowered women through direct selling but also became a massive success, racking up over $1 billion in sales and employing more than 800,000 reps globally. Mary Kay became a beloved figure in women's entrepreneurship, and her legacy continues to inspire countless others even after her passing in 2001.

What can we learn from this new podcast about MKA? How to think differently about reward and recognition. In 1967, Ash ordered a custom pink Cadillac Coupe de Ville that matched the blush in her makeup compact. This led to the official launch of the "Career Car Program" in 1969, where she rewarded her top five independent sales directors with their own pink Cadillacs. The pink Cadillac emerged as a powerful symbol of achievement. The program is still running today, with high-achieving salespeople offered a two-year lease for the car paid for by the company, or a cash compensation option.

🧠 Think: 2026 won’t be easier than 2025, but we’ll be better at handling it

This issue marks #90 and closes out my fourth year of The Supply Times. When I started this back in 2021, I just wanted a place to share observations twice a month. It turned into something else entirely: a way to force myself to think clearly, a connection to readers I didn't expect to meet, and a real-time log of a pretty wild era for our industry.

If 2025 taught me anything, it’s that uncertainty isn’t a phase, it’s the job. Geopolitics isn't settling down, it's speeding up. AI moved from "cool experiments" to actual production. And workforce challenges? They definitely didn't get any simpler.

But here is what gives me hope for 2026: We’ve built muscle. The procurement pros I talk to aren’t asking "what if" anymore; they’re stress-testing for "when." We aren't just hoping things calm down, we're building better boats for the choppy water.

Thanks for being part of this journey.

Charts of the Week

Quote of the Week

“Until you make the unconscious conscious, it will direct your life and you will call it fate.”

–Carl Jung

Tweet of the Week

The Final Chuckle

|

Thanks so much for reading. I’d love to know what you think about this issue and how I can make it more useful to you. If you have suggestions or topics you want to see me address, email me at [email protected]!

-- Naseem