- The Supply Times

- Posts

- Nuclear is Back!

Nuclear is Back!

The Supply Times Issue #84

Hello again, dear readers!

We’re back in the Atomic Age! Or it feels like it, anyway, with the Doomsday Clock set at 89 seconds to midnight, Russia rattling its nuclear sabres, and investment in nuclear power suddenly back in fashion. In this issue, I explore three reasons why nuclear plants, maligned for so long as too expensive to build and run, are now making a whole lot of sense for the U.S.

Also, I’d like to share something a little different this week, in the form of some excellent and actionable insights from a friend of mine in the procurement world - Resource Partners’ Ana Paula Zamorano.

This issue features the usual bunch of AI Insights and recommendations for the week's podcasts, books, shows, charts, and tweets, followed by a final chuckle.

Let’s get going.

Industry Highlights: Three Reasons Why Nuclear Is Back

Nuclear energy is experiencing a renaissance. After two decades marked by delays, cost overruns, and a general decline in public support, the nuclear industry is glowing again with promise. The Economist shared three reasons why nuclear is experiencing a revival and why it might just stick around this time.

1. Energy Independence and Security

In a world increasingly fraught with geopolitical tensions and energy supply uncertainties, governments around the globe are in desperate need of reliable and independent energy sources. The U.S. is no exception. The mantra “Make America nuclear again,” championed by former Texas Governor Rick Perry, signifies a shift in attitude toward nuclear power. Perry's initiative, Fermi America, aims to create the world’s largest energy and data-center complex outside Amarillo, Texas. This facility will initially generate power using natural gas and solar energy but will eventually incorporate conventional nuclear reactors and several small modular reactors (SMRs), targeting a massive output of 11 gigawatts (GW).

Nuclear power is becoming increasingly attractive as fossil fuel supplies grow more volatile and climate concerns rise. With the U.S. striving for energy independence, the potential for nuclear to fill that gap is substantial. The Trump administration has ambitiously called for a quadrupling of the country’s nuclear capacity to 400 GW by 2050. While this target may be overly optimistic, it has certainly mobilized political support and favorable legislation. The One Big Beautiful Bill Act provides tax credits for nuclear projects.

Across the Atlantic, the European Commission has forecast that nuclear capacity will rise from 100 GW to as much as 145 GW by 2050. Germany has reconsidered its stance on nuclear energy, classifying it as "green" in European legislation, thus paving the way for new projects. Remember, this is playing out against a plan to halt all Russian oil and LNG imports.

2. Power-Hungry Data Centers

The insatiable appetite for power from data centers is another driving force behind nuclear's resurgence. Data centers require enormous amounts of electricity; a topic I dedicated an issue to around this time last year. This demand creates a pressing need for reliable, consistent power sources, making nuclear an appealing option.

Big tech companies are now recognizing that nuclear energy can effectively complement their renewable energy initiatives. For instance, Google is partnering with Kairos Power and the Tennessee Valley Authority to purchase power from small modular nuclear reactors (SMRs) for its data center. Meta and Microsoft are actively investing in nuclear technology. Meta's recent 20-year deal to fund the life extension of the Clinton Power Station in Illinois highlights how tech giants are stepping into the energy fray, providing the necessary capital to revitalize aging nuclear infrastructure.

This influx of investment is crucial, as it brings fresh perspectives and innovative approaches to an industry that has often been seen as stagnant. With more than $2 billion raised by SMR startups since early 2024, the nuclear sector is becoming a hotbed of innovation, attracting attention from venture capitalists and tech leaders alike. The promise of smaller, more adaptable nuclear systems (SMRs) could help address the power demands of future data centers while also reducing the upfront capital costs typically associated with nuclear projects.

3. Learning from International Successes

Finally, one of the most significant challenges facing the U.S. nuclear industry is its ability to build reactors efficiently and economically. The answer may lie in learning from international competitors, particularly (gasp!) China. The Chinese and South Korean nuclear industries have demonstrated that it is possible to construct large reactors quickly and on budget. They have standardized designs, built multiple reactors per site, and moved swiftly between projects to keep their workforce and supply chains active. This approach has resulted in completion timelines that are significantly shorter than those typically seen in the U.S. and Europe.

China has shown that nuclear power construction and operational costs in the life of a reactor “don’t have to rise and rise”, according to an analysis published by Johns Hopkins. China’s extensive electricity market provides a level of demand certainty that has spurred investment in supply chains and infrastructure. The U.S. could potentially replicate this success by adopting financing models that aggregate heavy power users—like tech companies—to fund nuclear fleets through risk-sharing partnerships and long-term contracts.

New financial models and operational practices are essential to tackle the historical economic challenges that have plagued nuclear projects. Barclays has noted that the costs of both conventional nuclear and SMR projects currently exceed market prices for power. However, innovative partnerships and operational efficiencies could change this landscape. The Nuclear Company and Westinghouse are already looking to adopt a “design once, build many” strategy to streamline the construction of nuclear plants.

Atomic Era, Part II

The nuclear renaissance appears to be a response to urgent global needs for energy independence, the demands of power-hungry data centers, and the potential for innovative financial and operational models. The industry is being revitalized by tech investments and the lessons learned from international successes.

The Future of Work: Generate Value in PE-Backed Companies with Speed and Sourcing Know-How

We often hear a lot about how procurement is transforming into a key driver of value for organizations, but what does that actually look like in real life? McKinsey’s recent article on procurement at Toll, a logistics giant, gives us some concrete examples. Toll moved away from viewing procurement as a back-office function and became a strategic player by setting up cross-functional teams with a mandate to break down silos within the organization. Another impressive point from the article is how Toll focused on data to drive their decisions, analyzing patterns in asset utilization to figure out how to improve efficiency and reduce trucking costs. Plus, they encouraged employees to take ownership of their projects, which boosted morale and led to innovative solutions.

Here’s another real-life example, written by a good friend of mine and Founder/CEO of ReSource Partners, Ana Paula Zamorano. Ana Paula has some excellent insights into procurement’s role as a value-driver in PE-backed companies.

By Ana Paula Zamorano

PE-backed companies don’t win on austerity; they win on execution, growth, and precision. The fastest way to expand EBITDA isn’t headcount cuts—it’s smarter sourcing of third-party spend. By locking in quality while lowering the acquisition cost of products and services, procurement becomes a growth engine, giving sponsors EBITDA expansion without slowing momentum.

The 7–10x ROI Play

Funds unlock ROI through structured sourcing programs or targeted strikes in high-spend categories, especially at contract renewals. Speed and sourcing know-how are what generate cash savings that compound over time.

Across PE-owned firms in insurance, REITs, manufacturing, and FinTech, the pattern is consistent: tackle millions in addressable spend, deliver measurable savings of 5–50%. Program costs stay under 2% of addressed spend, payback is fast, and sponsors routinely capture 7–10x ROI—without sacrificing service or quality.

Technology

Biggest wins come from smart SaaS, infrastructure, and IT services negotiations. Bundling, right-sizing usage, reshaping terms, and locking in multi-year protections improve reliability and security while reducing cost—often by 15% or more, with stronger SLAs and fewer surprises.

Marketing

Discipline works best where quality is measurable. Unbundling media, platform fees, and data spend, then tying costs to outcomes, drives down total spend. Standard rate cards and volume rebates keep creep in check, while rationalizing overlapping tools frees dollars for the highest-performing platforms. Results: double-digit savings with no loss in productivity.

HR Services

Employee benefits are a major cost driver. Smarter sourcing here cuts costs while making benefits more attractive for talent. In contingent labor, the right VMS/MSP partner—paired with market-based rate cards, compliance controls, and SLAs—delivers impact and improves workforce agility.

Industry Playbooks That Work

Insurance: Negotiate cost-competitive lead generation, IT, and travel services.

REITs: Centralize technology, marketing, and facilities to replace site-by-site pricing with portfolio-wide contracts.

Manufacturing: Aggregate MRO, IT, and HR spend across plants to reduce indirect costs and production overhead.

FinTech: Optimize SaaS and professional services to cut recurring OpEx.

Different sectors, same outcome: strategic procurement drives EBITDA by lowering third-party costs.

The Better Alternative to Headcount Cuts

Both supplier savings and labor cuts drop to EBITDA. Only one preserves execution capacity and fuels growth. By retaining talent and extracting waste from suppliers, PE firms protect customer experience, accelerate launches, and compound value creation.

How to Get There

Start with a clean view of spend. Spot the big opportunities—Technology, Marketing, HR—and map them to owners and contract expirations. Move systematically:

Run market processes that allow apples-to-apples comparisons.

Anchor decisions in ROI, not anecdotes.

Lock in protections: multi-year pricing, volume brackets, outcome-based fees, SLAs, credits, rebates, and demand safeguards.

Build supplier governance—QBRs and KPI dashboards—to sustain gains through leadership changes and budget cycles.

Address $10M in spend, capture a conservative 12% in savings, and you’ve added $1.2M of annual EBITDA. If it costs $120K to deliver, that’s a 10x ROI. More importantly, it’s a repeatable playbook that builds lasting advantage.

If this resonates with you, if you disagree and have war stories to share, I’d love to compare notes. To continue the conversation on this topic, share your insights and contact me. [email protected]

AI Insights

Palantir CEO Believes LLMs Overhyped: Alex Karp launched a broadside at Silicon Valley recently, saying AI companies “totally effed up” and oversold LLMs. He believes “quick-fix chatbot vendors” are trying to skip the engineering effort needed to generate real power from LLMs, which only gain value (in his opinion) after rigorous processing through Palantir’s existing software.

San Jose is Trialing an AI Smart City: San Joe Mayor Matt Mahan is testing AI to improve the efficiency of public services, including transit scheduling, pothole detection, and grant writing. The city is well-positioned to do so, with a high percentage of California’s AI talent and Nvidia’s headquarters, and a semiconductor cluster located in the city.

AI Voice Agents Enhance Blood Pressure Reporting: Preliminary research at the American Heart Association’s Hypertension Scientific Sessions revealed that AI voice agents enhanced blood pressure reporting accuracy among high-risk patients, achieving an 85% reach and 60% compliance rate, while significantly reducing costs. The automation improved satisfaction scores from 1 to 4 stars in just ten weeks, demonstrating AI's potential to enhance care quality and ease clinician workloads.

Image: https://www.scotthyoung.com/

The Supply Aside

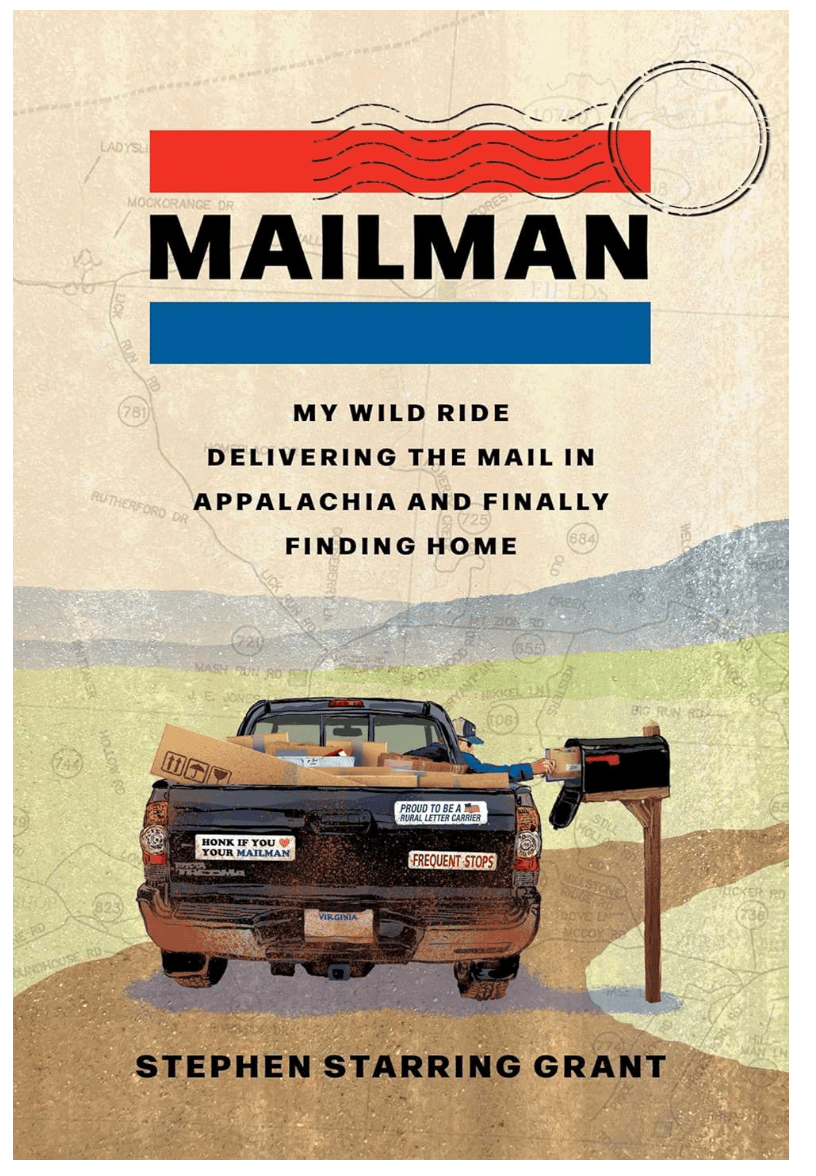

Steve Grant lost his white-collar job around the beginning of the pandemic. Fifty years old, battling cancer and panicking about health insurance, he returned to his old hometown in Appalachia and took a job as a rural letter carrier. In no time, he’s climbing mountains, fording creeks, and enjoying the thrill of a wild new challenge.

This is an excellent little memoir about Grant finding dignity and meaning in a different kind of job, enjoying the camaraderie of eccentric letter carriers, being a lifeline for lonely people, and enjoying providing a service: “a small, good thing”.

What Else I’m Reading

How to pack for a business trip: CEOs share travel tips and tricks, including vacuum-packing and keeping a shoe in the hotel room safe so you don’t forget your important items. It even includes some packing tips from “The Mooch”, Anthony Scaramucci.

Job hopping is out, “job hugging” is in: This gloomy article explores how more employees are clinging to their positions out of fear of the uncertain job market, with negative consequences: disengagement is rife, and career advancement is slowing as co-workers refuse to vacate the next rung on the ladder.

Ironman to become a lifestyle brand: CEO Scott DeRue aims to transform Ironman Group into a lifestyle brand rather than just a race organizer, focusing on how to support athletes through new initiatives like a digital portal for local travel events. While expanding product offerings and partnerships with brands like Hoka and Athletic Brewing, he remains dedicated to enhancing the racer experience.

Dyslexia, one could argue, is nowhere near as disadvantageous today as it used to be. Wider recognition of the disability, along with tools like GenerativeAI, mean sufferers have better support in their schooling and working lives. But this was definitely not the case when Schwab was a young man struggling with an undiagnosed condition.

Describing devastating market crashes and several major financial challenges, this documentary from FINAIUS shows how dyslexia was just the first limitation that the ever-humble Charles Schwab treated as a “stepping stone to greatness”. It’s a story of persevering through adversity to build one of the largest financial empires in history.

👂 Listen - How I Built This: Ben Leventhal’s Resy and Eater

Get ready for some food puns, because this tasty podcast episode describes Ben Leventhal’s recipe for success. Starting as a blogger dishing out juicy insights about NYC restaurants, Leventhal cooked up Eater with co-founder Lockhart Steele, which became a go-to for all things dining. But Leventhal didn’t stop there. Teaming up with co-founders including the dynamic Gary Vaynerchuk, he also whipped up Resy, a reservation app that aimed to squeeze extra value out of every table. After a rocky start, a smart pivot, and a white-knuckle period of survival when restaurants closed during Covid, Resy paid off big time when American Express gobbled it up for a cool $200 million in 2019.

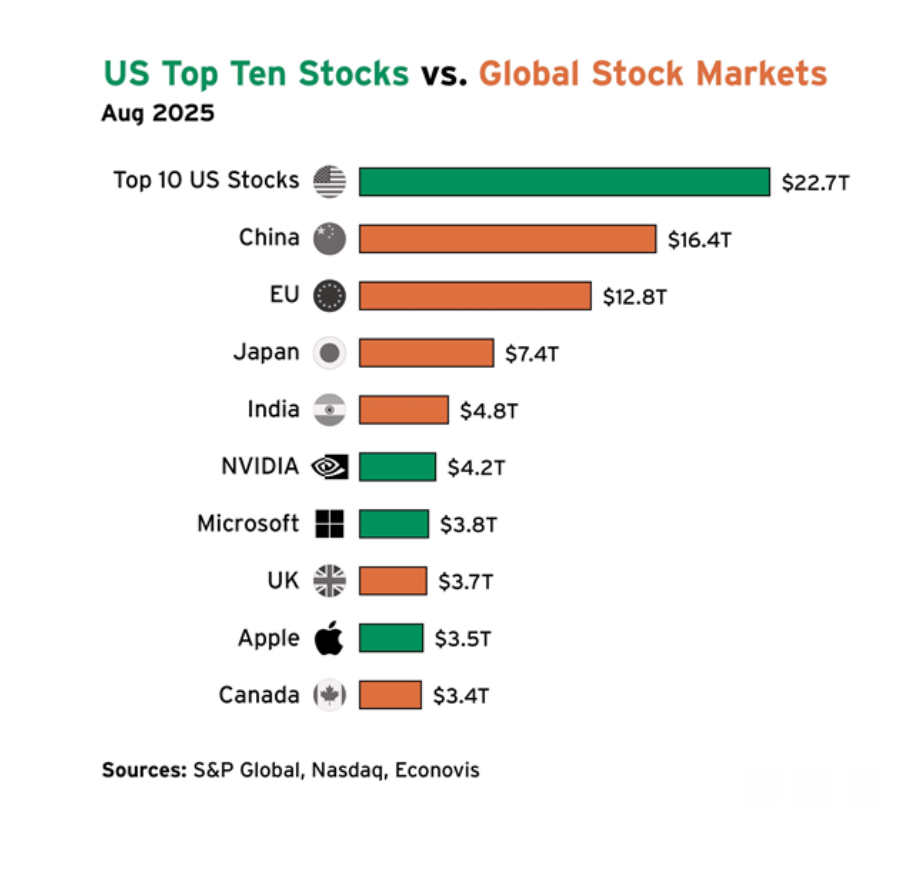

Charts of the Week

Quote of the Week

“Nothing is so firmly believed as that which we least know.”

- Michel De Montaigne

Tweet of the Week

The Final Chuckle

|

Thanks so much for reading. I’d love to know what you think about this issue and how I can make it more useful to you. If you have suggestions or topics you want to see me address, email me at [email protected]!

-- Naseem