- The Supply Times

- Posts

- Debunking China's Rare Earths Dominance

Debunking China's Rare Earths Dominance

The Supply Times Issue #83

Hello again, dear readers!

We need rare earths. They’re the backbone of our future tech, but is China’s grip on them really as strong as it looks? With countries scrambling for alternatives, the future of rare earths could get interesting. Dive in below to see what’s really happening in this crucial market.

Also, the British-Pakastini writer Nadeem Aslam once wrote: “Pull a thread here, and you’ll find it’s attached to the rest of the world.” Ever-increasing interconnectedness is the driver behind a growing need for systems thinking in innovation. Ever wondered why fixing one thing so often seems to cause something else to break? Find out why below.

This issue features the usual bunch of AI Insights and recommendations for the week's podcasts, books, shows, charts, and tweets, followed by a final chuckle.

Let’s get going.

Industry Highlights: Debunking China’s Rare Earth Dominance

China's grip on the rare earths market often feels unbreakable, but that’s not the whole story. While China supplies over 90% of the world’s refined rare earths, it doesn’t own all the deposits, nor is it the only player in the refining game. What gives China the edge is its willingness to overlook environmental standards and its massive scale, which allows it to refine these minerals at lower costs than other countries.

A Misunderstood Monopoly

Although they’re called "rare earths," these minerals are actually pretty abundant; less than half of the known reserves are in China. The refining process can be complex and polluting, but it’s not as advanced as making high-tech gadgets. The U.S. used to be the top supplier until the 1980s when China’s lax environmental rules gave it the upper hand. This led to the perception that China has a monopoly, but its dominance is really about efficiency and scale rather than exclusive access to resources.

China’s ability to refine rare earths cheaply comes at a cost; specifically, environmental costs. Its willingness to overlook pollution means cheaper production, but other countries that prioritize environmental standards face higher costs. This gives China a competitive edge, but it also opens the door for other nations to invest in cleaner, sustainable practices.

The Stockpiling Crackdown

Recently, China has ramped up its efforts to control the rare earths market by warning foreign companies not to hoard these critical minerals. Chinese authorities are intentionally limiting approved export volumes to stop foreign stockpiling, showing their determination to keep a tight grip on this vital sector. This strategy aims to prevent foreign companies from having the flexibility to handle market fluctuations, further solidifying China’s control.

China processes about 90% of the world’s rare earths and produces 94% of permanent magnets. By placing several categories of rare earths on an export control list, Beijing is using its influence in the ongoing trade war with the U.S. as leverage, treating these minerals like a bargaining chip.

Rare Earths Restrictions

This approach highlights China’s intent to use its rare earths dominance as a power play. Recent actions have triggered significant shortages in various industries, especially in the automotive sector. While the U.S. and China have agreed to extend their tariff truce, China's restrictions on rare earths remain a hot topic. Reports show that half of the applications for rare earths from foreign companies are either pending or rejected, demonstrating China’s tight control over exports.

Because of these restrictions, some Western companies are shifting production of finished goods to China. This allows them to assemble rare earth magnets locally and navigate export challenges more easily. It illustrates how global supply chains and national interests are intertwined, with China using its rare earths dominance to sway international negotiations and industry practices.

A Shift Towards Alternatives

The panic around China’s export restrictions has sparked a renewed interest in finding alternatives. Countries like Japan have invested in rare-earth mines and started building stockpiles to reduce their dependence on China. Earlier this year, the Pentagon took a stake in MP Materials, a California miner, which has even led to a deal with Apple. In total, 22 new mining projects are expected to be up and running by 2030.

Even a slight erosion of China’s dominance—from 90% to 80%, for instance—may not seem significant, but it could effectively double alternative sources of supply, giving China’s customers much more room to maneuver.

Geopolitics and land-grabs

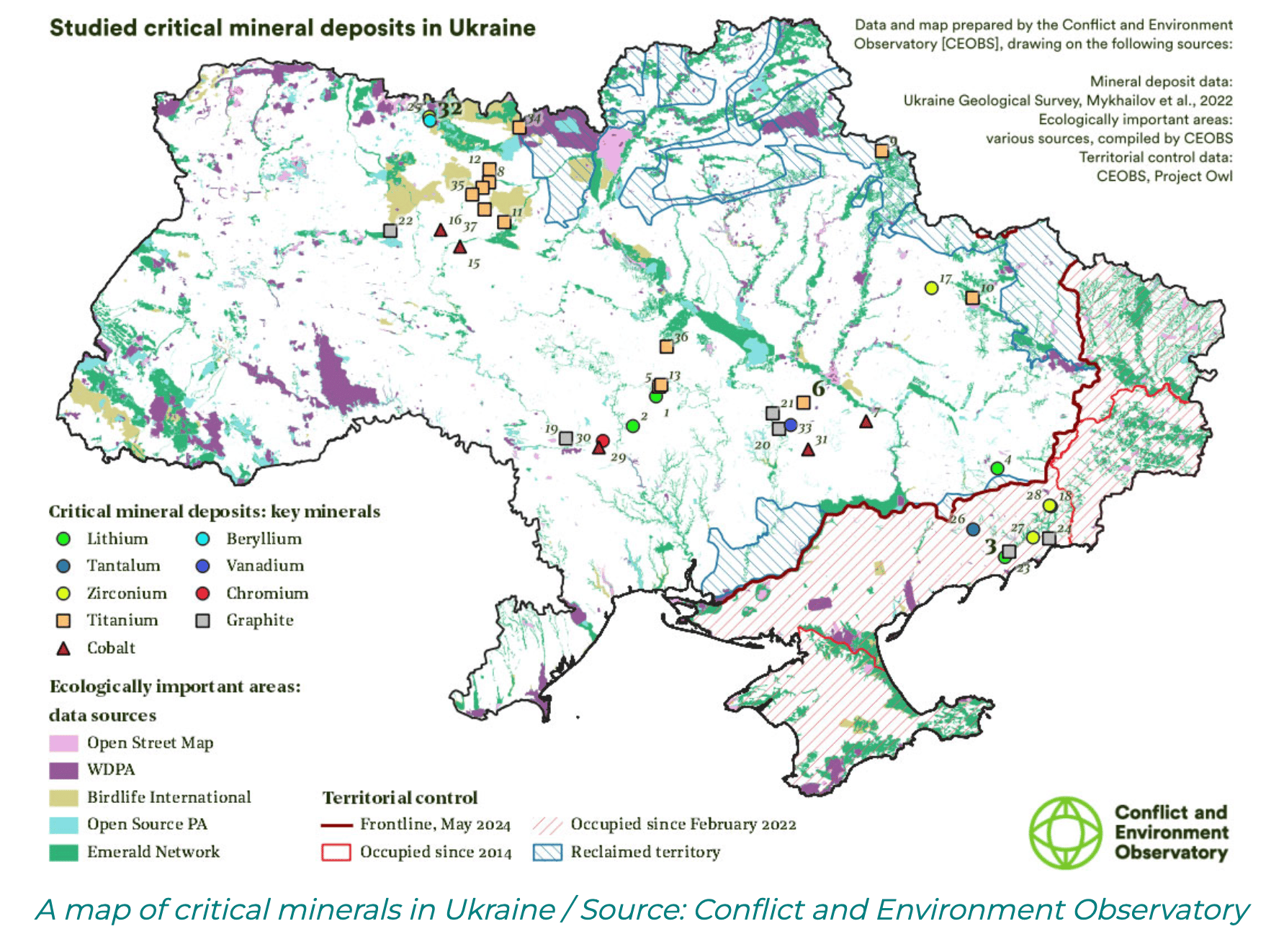

An oversimplified (and cynical) view of the first and second Gulf Wars were that they were essentially a grab for Iraqi oil wealth. A similar argument exists about our administration’s interest in post-war Ukraine. Ukraine sits on vast, largely untapped critical mineral wealth, and Trump’s May 2025 deal with Zelensky gives the US preferential rights to mineral extraction. Perhaps Putin has the same motivation; when you look at a map of Ukraine, it becomes a little clearer why he’s so focused on winning control of the Donbas, a region rich with graphite, zirconium and other critical minerals.

Greenland, too, has recently attracted the Trump administration’s interest. Yes, it’s a strategically important buffer from a military standpoint. But it also happens to contain some of the world’s largest rare earth deposits.

Innovation as a Response

While diversifying supply chains is essential, innovation is also a powerful response to China’s control over the rare earth market. Startups in the West are working on new ways to recycle rare earths and create alternatives for magnets and motors that don’t rely on them. Companies like BMW and Renault are already producing electric vehicles that don’t use rare earths, showing that the industry can adapt and innovate in response to supply challenges.

Watch this space

China's weaponization of rare earths in recent trade dynamics clearly shows its intent to maintain a commanding position in the global market. By leveraging its control over these vital minerals, China aims to boost its economic interests while exerting political pressure on other nations. The narrative of China’s dominance over rare earths is ripe for disruption as countries invest in alternative sources and innovative technologies.

The Future of Work: We Need Systems Thinking More Than Ever

Why should innovation, while fixing one problem, so often cause something else to go wrong? The invention of plastic made our lives easier but has polluted the entire globe. Breakthrough technologies, like fracking, have driven down energy costs but also contaminated water supplies. As Tima Bansal and Julian Birkinshaw pointed out in their recent HBR article, traditional innovation methods often lead us into a minefield of unintended consequences. It’s becoming clear that we need an approach that embraces the complexity of our interconnected world: systems thinking.

The Pitfalls of Traditional Innovation Methods

Two popular methods dominate the innovation landscape: breakthrough thinking and design thinking. While both have their merits, they often overlook the world’s interconnectiveness, leading to negative ripple effects that can harm both society and the environment.

The main message here? You’re not innovating in a vacuum. Everything has consequences.

Breakthrough Thinking

Breakthrough thinking is all about bold moves and radical changes. Think of tech giants like Uber and Google, who have made headlines for shaking up entire industries. However, this approach can lead to significant collateral damage. For instance, when Uber entered new markets without engaging local taxi drivers or authorities, it disrupted livelihoods and created regulatory backlash. Similarly, Google’s aggressive data collection practices have raised serious privacy concerns.

Design Thinking

On the other hand, design thinking focuses on understanding user needs and creating solutions tailored to them. While this method can yield valuable user-centric products, it often ignores the broader implications. Take Airbnb, for example. While it provided homeowners and travelers with new opportunities, it also strained local housing markets and disrupted communities. In both cases, the focus on solving immediate problems led to long-term issues that were not fully considered.

Embracing Systems Thinking

So, how can we avoid these pitfalls? Enter systems thinking, a holistic approach that encourages us to look beyond the immediate impact of our innovations. Here are some key principles to help guide us:

1. Define a Clear Vision

Rather than just focusing on the product or service, start by defining what you want to achieve within the larger system. This means articulating a vision that embraces sustainability and social responsibility. For example, a food company might shift its focus from merely processing meat to promoting sustainable protein sources, recognizing its role in a healthier food system.

2. Reframe Problems Collaboratively

Problems can be multifaceted in complex situations. Instead of sticking rigidly to a single definition, be open to redefining the issue as you engage with stakeholders. For instance, a university focusing on climate change might find more resonance by shifting discussions to soil health, which directly impacts farmers and their everyday concerns.

3. Prioritize Relationships and Flows

Instead of solely concentrating on creating new products, think about how to improve relationships and flows within your network. This could mean collaborating with partners to streamline processes or enhance communication. For example, an insurance company might work with contractors to implement sustainable practices that reduce waste, ultimately benefiting everyone involved.

4. Experiment and Nudge Forward

Systems thinking encourages small, incremental changes rather than massive overhauls. By conducting experiments and nudging the system in a positive direction, you can uncover insights that lead to meaningful improvements. This approach minimizes risk and fosters a culture of innovation that adapts and evolves.

Traditional innovation methods, while popular, often fall short by failing to consider the broader implications of their actions. By embracing systems thinking, we can create solutions that are innovative, sustainable and socially responsible. It’s time to shift our perspective and recognize that the future of innovation lies in understanding the interconnectedness of our world. Let’s make thoughtful choices that benefit not just our businesses, but society as a whole.

AI Insights

LLM users demonstrate lower brain engagement with writing tasks: MIT researchers have confirmed something most of us suspected already: essays generated using AI are more homogenous, while non-AI users come up with a wider variety of arguments. Those using LLMs struggle to recall their own content, while EEG scans showed up to 55% lower neural connectivity than non-AI writers.

Turning AI agents into “the perfect intern”: This article provides five ways to successfully integrate AI agents into the workplace, from having “adult discussions” with the AI to ensuring your human team has the skills to manage these agents.

Has Grammarly solved student plagiarism? Grammarly has launched a host of AI agents within its new AI-native Docs tool for students, including an AI grader, reader reactions predictor, paraphrase assistant, citation finder, review agent, and of course a proofreader. For teachers, there’s a plagiarism and AI detector agent that promises to detect whether student work is original and human.

The Supply Aside

📕 Read - The Connection Cure by Julia Hotz

Over-medicated, over-prescribed polypharmacists, US citizens take far more prescription drugs than any other nation, with pharmaceutical companies making more revenue from US sales than from the rest of the world combined for several top-selling drugs.

It’s refreshing, then, to read about the rise of a better way of thinking about healthcare. The Connection Cure by Julia Hotz delves into the concept of social prescribing, which shifts the focus in healthcare from "What's the matter with you?" to "What matters to you?" Instead of relying solely on medications, healthcare professionals refer patients to community activities and resources, like art classes or gardening groups, that enhance well-being. This approach has proven effective for addressing common issues such as depression, anxiety, and loneliness, while also reducing wait times and hospitalizations.

What Else I’m Reading

J. Crew’s big comeback: Libby Wadle, the CEO of J.Crew, is on a mission to bring back the brand's iconic preppy vibe after surviving bankruptcy, focusing on quality and cultural relevance. With sales climbing towards $3 billion and new partnerships in the works, she’s confident that J.Crew is back in the fashion conversation and not going anywhere anytime soon.

Raising five children on a modest income: Many Americans are delaying or forgoing having children due to the skyrocketing costs of living, particularly housing and childcare, leading to a record low U.S. birthrate and a looming demographic crisis.

CEOs are getting tougher. They’re reasserting control over their employees with strict attendance policies and heightened productivity demands amid rising job cuts and the integration of AI. Companies like Amazon and BlackRock are mandating in-office work and taking a hard stance against dissent.

📺 Watch - Farewell to Poverty

Image: John Maynard Keynes

Farewell to Poverty reveals how China eradicated absolute poverty in under 40 years; a journey described by economists as “The China Miracle”.

From 1981 to 2015, China’s poverty rate plummeted from 88% to just 0.7%, lifting over 850 million people out of extreme poverty, defined as living on less than $1.90 per day (2011 PPP). Key factors in this transformation include significant economic growth, which saw per capita income increase five-fold from $200 in 1990 to $1,000 in 2000, and then to $5,000 by 2010.

Historically, poverty was exacerbated under Mao's regime, with two-thirds of the rural population living below 1958 standards by 1978. However, post-1978 reforms shifted focus to economic development and social programs, such as urban subsidies and rural pensions, contributing to a substantial labor market expansion.

By 2018, only 16.6 million people lived below China’s national poverty line, and by late 2020, the government announced the elimination of absolute poverty nationwide. Despite this success, about 13% of the population still fell below the upper middle-income poverty line of $5.50 per day.

👂 Listen - Acquired: The Jamie Dimon Interview

A candid discussion with Jamie Dimon about his remarkable journey from being fired at Citigroup in 1998 to leading JPMorgan Chase, the world's most powerful bank. Dimon details how he transformed Bank One into the foundation of modern JPMorgan, emphasizing the "fortress balance sheet" (strong financial position, abundant cash reserves, and minimal debt). This interview covers Dimon’s strategy for navigating challenges like the Great Financial Crisis and ultimately positioning JPMorgan as a juggernaut with over twice the market cap of its nearest competitor.

💡 Think - The No-Win Zone of Leadership

Jerome Powell walks into Jackson Hole with a choice that could define his legacy. Does he protect jobs or tame inflation? US tariffs are fanning price pressures, but hiring has slowed to a crawl. Markets expect cuts, the White House is demanding cuts, yet the Fed’s credibility rests on not looking like it’s caving to politics.

The risk? A “Wile E. Coyote” moment where the economy suddenly plunges. That has Fed watchers calling for “insurance cuts” to steady the labor market, even as inflation remains above target. But if Powell moves too fast, the Fed risks repeating its 2021 “transitory” mistake. If he moves too slow, the labor market cracks deeper.

This is the no-win zone of leadership in that if you act too early, you lose trust. But if you vacillate, you can lose control. For Procurement folks, it’s familiar terrain. Balancing cost vs. risk when either misstep leaves you exposed. Powell’s gamble is just on a global stage.

Charts of the Week

Quote of the Week

“You gain strength, courage, and confidence by every experience in which you really stop to look fear in the face. You are able to say to yourself, 'I have lived through this horror. I can take the next thing that comes along.’ You must do the thing you think you cannot do.”

- Eleanor Roosevelt

Tweet of the Week

The Final Chuckle

|

Thanks so much for reading. I’d love to know what you think about this issue and how I can make it more useful to you. If you have suggestions or topics you want to see me address, email me at [email protected]!

-- Naseem